jersey city property tax assessment

Left click on Records Search. Online Inquiry Payment.

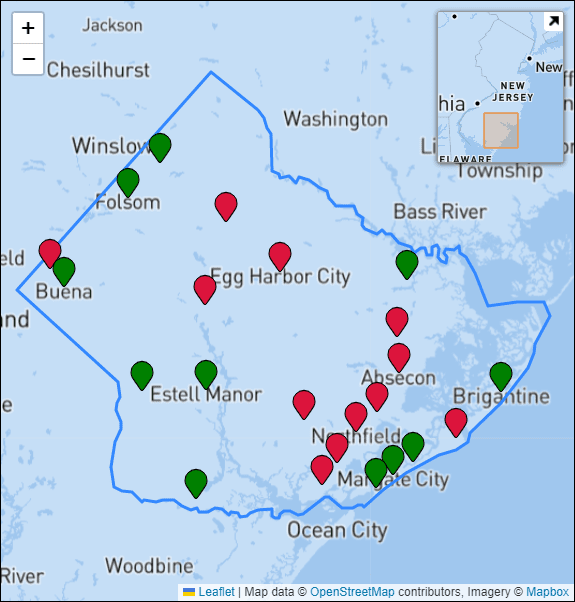

Atlantic County Nj Property Property Tax Rates Average Tax Bills And Residential Assessments

Online Inquiry Payment.

. Web Jersey City Finalizes 32 Property Tax Increase It is official. Web 2022 Jersey City Art Studio Tour - JCAST. Web New Jersey Property Taxes Go To Different State 657900 Avg.

Mayor Fulop Announces the Return of NJs Largest Art Tour the 32nd Annual Jersey City Art Studio Tour JCAST Learn More. Web General Property Tax Information. Web Welcome to the official website of the New Jersey Association of County Tax Boards NJACTB The NJACTB was established to foster fair and equitable tax assessment.

Web TO VIEW PROPERTY TAX ASSESSMENTS. Left click on Records Search. Jersey City has finalized the 2022 tax rate and it represents an unprecedented increase of 32 from.

Account Number Block Lot Qualifier Property Location 18 14502. Web 11 rows City of Jersey City. Open Public Records Act.

In compliance with New Jersey constitution property assessments are made by counties only. 14502 00011 Principal. Web 11 rows City of Jersey City.

Web City of Jersey City. Online Inquiry Payment. Web Contact the Office.

Web TO VIEW PROPERTY TAX ASSESSMENTS. For more information please contact the Assessment Office at 609-989. You can reach the Tax Collectors Office by calling 732-341-1000 ext.

Assessed Value x General Tax Rate100 There is a property tax levied on property owners. New Jerseys real property tax is an ad valorem tax or a tax according to value. 280 GROVE ST Bank Code.

Web For your convenience property tax forms are available online at our Virtual Property Tax Form Center. Web The main function of the Tax Assessors Office is the appraisal and evaluation of all land and buildings within the municipality for tax purposes according to. Web Who and How Determines Jersey City Property Tax Rates.

Last item for navigation. All real property is assessed according to the. Web Official records of the Jersey County Supervisor of Assessments and the Jersey County CollectorTreasurer may be reviewed at the Jersey County Government.

Please keep in mind that we tend to have much higher call volumes during tax. 189 of home value Tax amount varies by county The median property tax in New Jersey is 657900 per. Web In New Jersey property taxes are calculated using the formula.

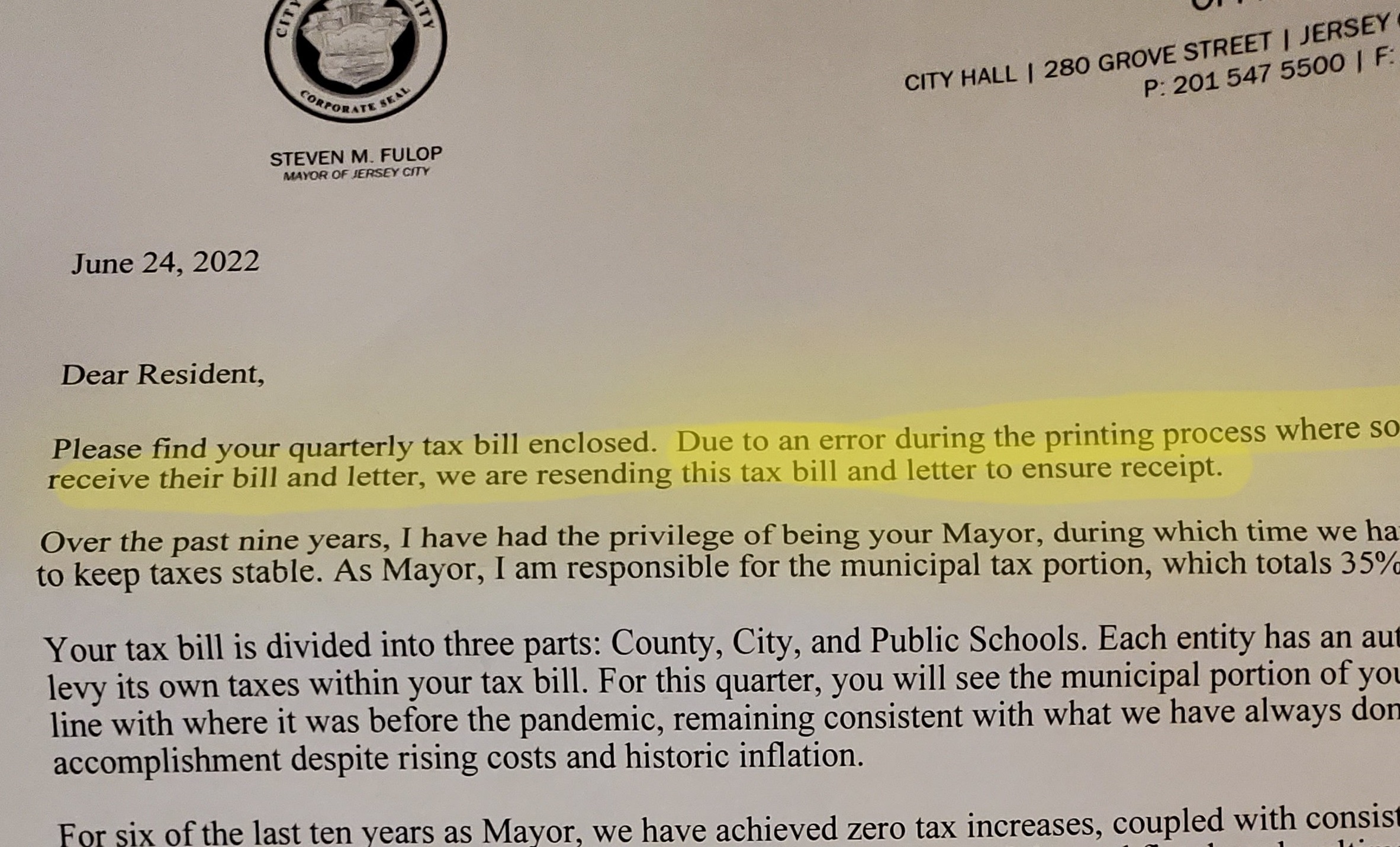

Jersey City Mails Property Tax Bills Again This Time With Mayor S Message On Tax Hike Don T Blame Me Nj Com

/cdn.vox-cdn.com/uploads/chorus_asset/file/19631892/detroit_homes.jpg)

How To Read And Appeal Your Detroit Property Tax Assessment Curbed Detroit

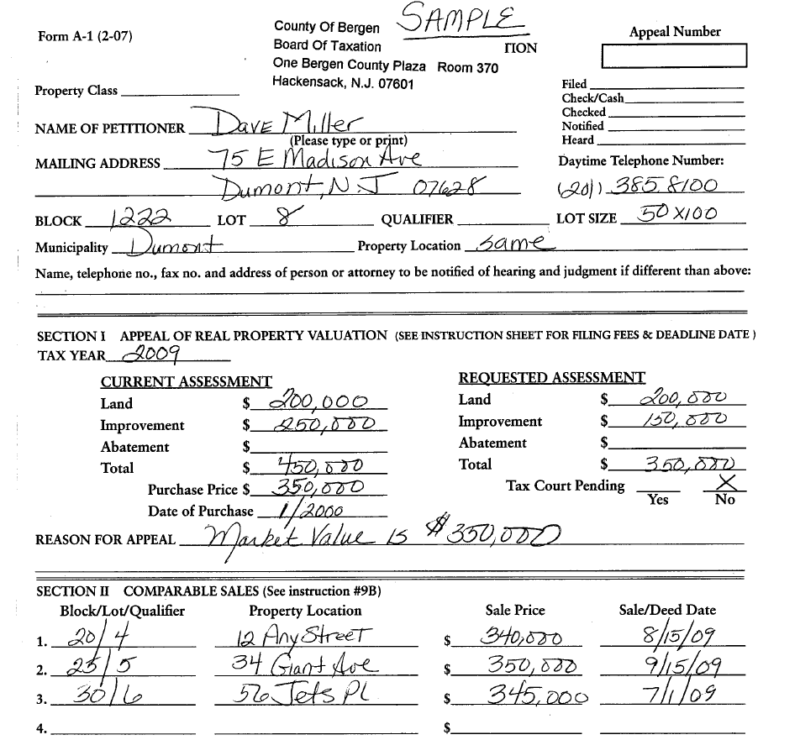

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

These Towns Have The Lowest Property Taxes In Each Of N J S 21 Counties Nj Com

City Of Jersey City Online Payment System

Tax Collector Bordentown Township New Website

How Can You Lower Your Property Taxes In Nj Askin Hooker Llc

.jpg)

Office Of Diversity Inclusion City Of Jersey City

Njactb Welcome To The Official Website Of The New Jersey County Tax Boards Association

Understanding Executing A Successful Property Tax Appeal In Bergen County Nj

Annual Secured Property Tax Bill Placer County Ca

Property Tax Definition History Administration Rates Britannica

Best Cheap Homeowners Insurance In Jersey City Bankrate

Jersey City Rising Civic Parent

Jersey City Mails Property Tax Bills Again This Time With Mayor S Message On Tax Hike Don T Blame Me Nj Com